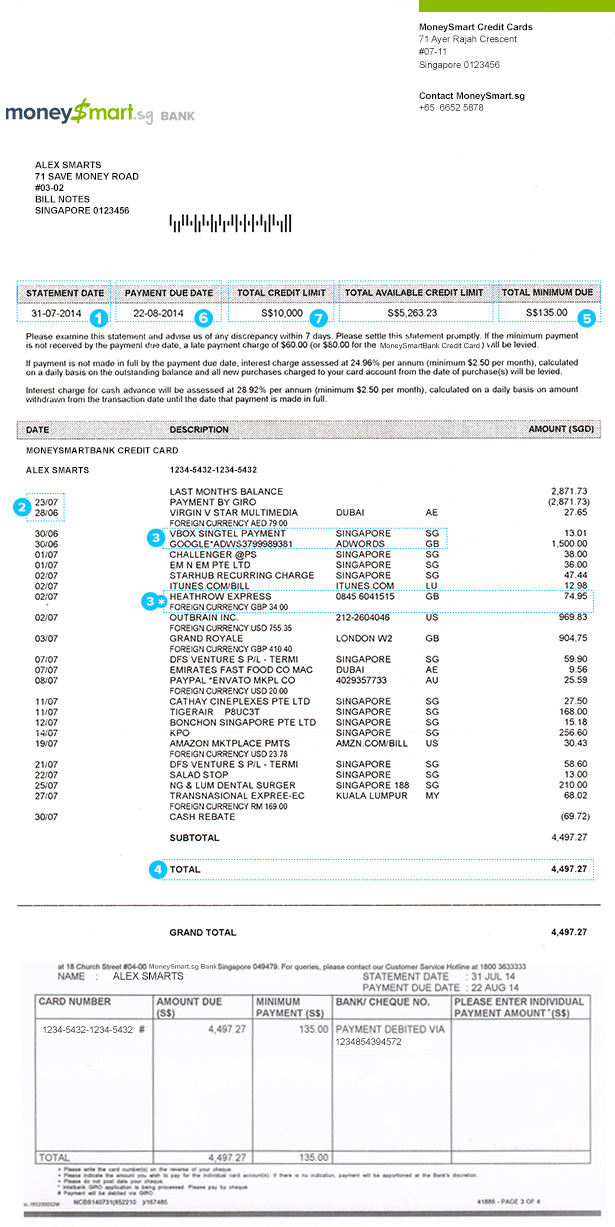

Having a credit card is great when you’re out and about using it – all you have to do is swipe it at the counter of your favourite retailer to get whatever you want… within the credit limit of course. But towards the end of the month, all that joy over your new purchases diminishes with the arrival of a certain document. Yes, I’m talking about your credit card statement! It doesn’t matter whether your credit card statement comes in by mail (you know you’re getting charged for that right?) or via email – what matters is its importance.

Because if you don’t understand your credit card statement (or worse, throw it away!), you’re setting yourself up for some serious financial pain down the road. Although credit card statements can vary in appearance (depending on the card issuer), most contain the following items – items that you MUST learn to understand:

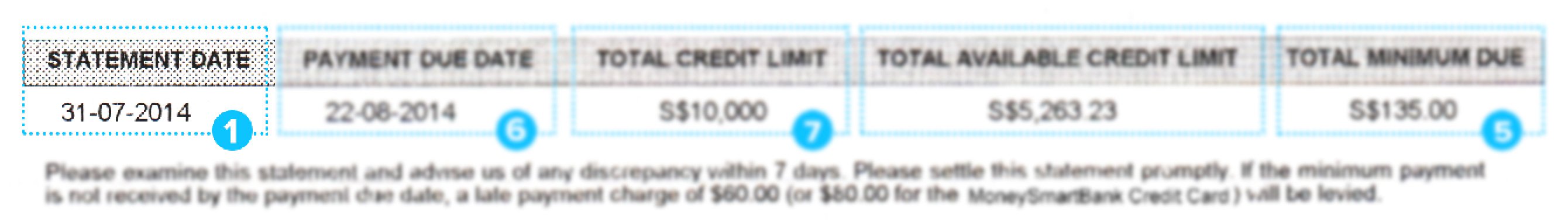

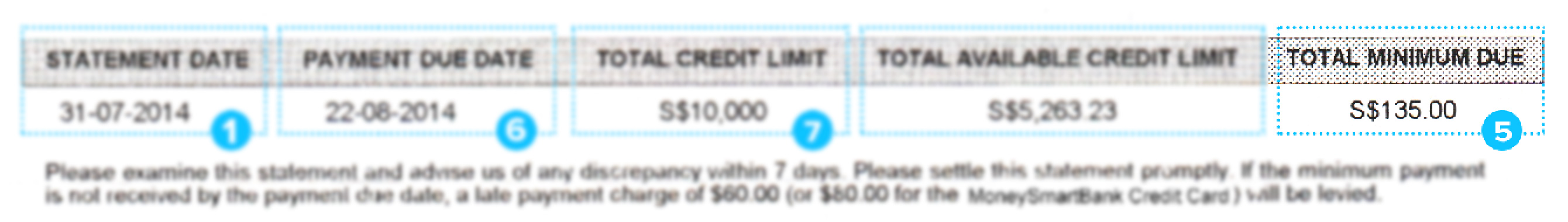

1. Credit Card Statement Date

The credit card statement date shows when your statement was sent by the financial institution (FI) or bank that issued your credit card(s). Your statement date also represents the last day that transactions with your card were recorded.

2. Transaction Date

The transaction date is the exact day you used your card to make a purchase.

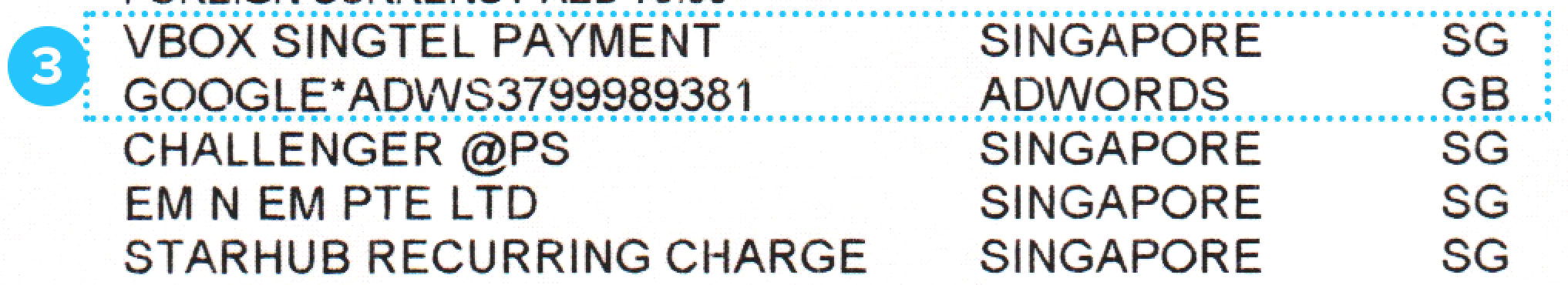

3. Description

The description will indicate the nature of the purchase and the retailer. Keep in mind that finance charges and payments made to the credit card issuer will also be reflected in the description by a general term such as “PAYMENT –THANK YOU” or “FINANCE CHARGE”.

*Note: If you have multiple credit cards with a particular FI or bank, the purchase descriptions will be divided by the credit card number and/or user if a supplementary credit card has been issued.

Example: John Tan 4544-XXXX-XXXX-6552 / Evelyn Tan 4544-XXXX-XXXX-6711

* Note:  If you have made a purchase in a foreign currency, this will be reflected in the amount as well, followed by the transaction amount in SGD (keep in mind transaction fees ranging from 2.5% to 3% will be factored into the amount).

If you have made a purchase in a foreign currency, this will be reflected in the amount as well, followed by the transaction amount in SGD (keep in mind transaction fees ranging from 2.5% to 3% will be factored into the amount).

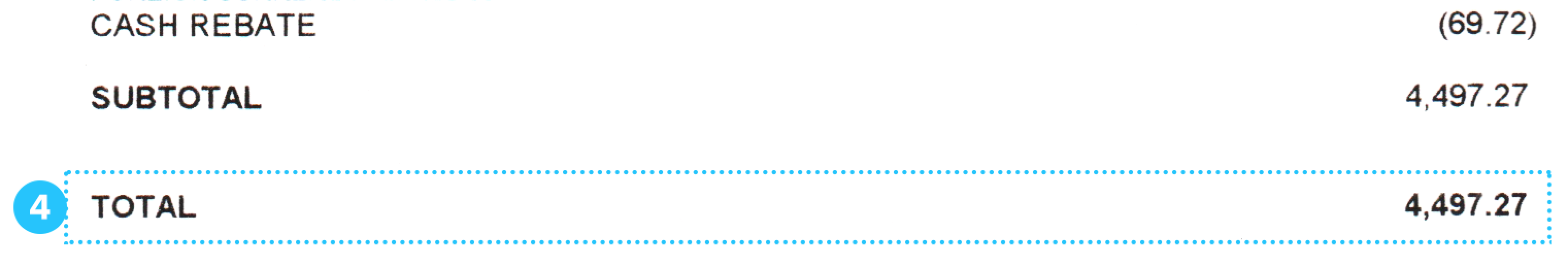

4. Total Account Balance

The total account balance on your credit card statement refers to the complete balance on your account including your previous statement balance, payments and purchases.

5. Minimum Payment

The minimum payment is the absolute minimum you can pay on your credit card balance. The minimum will be either 3% of your outstanding balance or $50, whichever is higher.

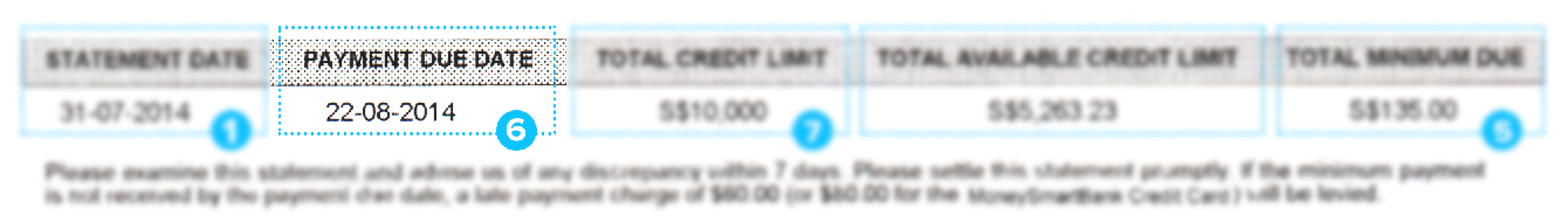

6. Payment Due Date

The payment due date is the last day you can make payment without incurring late fees. To be safe, you’ll want to make payment by no later than close of business the day it’s due (typically 5pm same day).

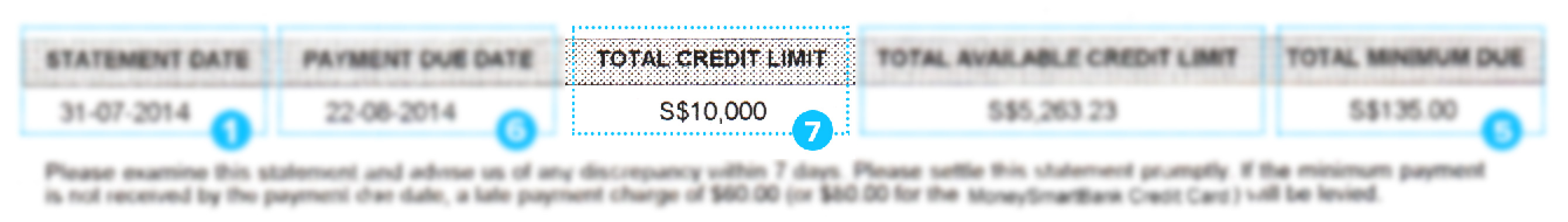

7. Total Credit Limit

The total credit line on your statement represents how much you can “borrow” under one or more credit card accounts with the credit card issuer.

Example: Credit Limit (SGD) 10,000.00 Even if you honestly can’t comprehend an item (or several) within your credit card statement, the FI or bank issuing the card won’t see your misunderstanding as a valid excuse to miss a payment or underpay.

- Recommend using a real/sample credit card statement and colour coding the items above with the sections that relate to them on the real/sample statement.

Not Featured

Rewards Summary If your credit card has a rewards programme, the tally of the points you earned previously, earned during the statement month and redeemed will be present.

Example:

Previous Earned Points 23,000 Points Earned 500 Points Redeemed 7,000 Total Points Balance 16,500